city of chattanooga property tax increase

Regulatory Bureau Board City Council. The City of Chattanooga will assist residents in filling out their tax relief application at various community centers from Nov.

Chattanooga City Hall 101 E 11th St Room 100 Chattanooga TN 37402-4285-----Paying Property Taxes by Credit or Debit Card.

. All property tax exemption requests should be directed to the Hamilton County Assessor of Property at 423 209-7300. The funding plan which covers the fiscal year from July 1 2022 to June 31 2023 does not contain an increase to the citys property tax. 423-643-7262 or email ptaxchattanoogagov.

Payments by Credit Card or Debit Card will incur the following charges whether you pay in person online or over the phone. For inquiries regarding business license. Chattanooga TN 37402 map 423 643-7262.

The old tax rate was 27652 per 100 of assessed value. Dependent upon approval for either Senior Tax Freeze or Property Tax Relief. VITA is sponsored by the IRS City of Chattanooga United Way of Greater Chattanooga UT Extension and Tennessee America Saves.

Everyone says TN has a low cost of living due to no state income tax but you are taxed more via property taxes in metro areas. These are the new certified tax rates for Hamilton County and its municipal governments that were submitted on July 14. That means your assessed value is about 200K.

Based on your assumption that an 18 increase will cost you 1000 more per year that means your current tax is 5500. Then question if the size of the increase justifies the time and effort it will take to appeal the appraisal. To reach our Technical Assistance Center.

Since assessed value is about 14 the price of your home you must have paid at least 800k for your home. 8 to to Feb. To make an appointment please call 423 643-7274.

Dial 311 or 423-643-6311 or email 311chattanoogagov. Third and maybe not so obvious there are those long lists of salaries for Hamilton County the city of Chattanooga and the Department. United Way of Greater Chattanooga.

Myrtle Beach City Council approved its 292 million budget at Tuesdays council meeting which includes a property tax increase. For inquiries regarding property taxes. Technologies provides enterprise wide business and technology solutions for the City of Chattanooga local government.

Regulatory Bureau Board City Council. Might get it lowered a little. We paid more than double what we pay now here and thats with the new increase.

The city of Chattanooga will rely on a proposed 30 million increase in property tax revenue for the budget year that started last month to fund employee raises. Check your real tax bill including any exemptions that pertain to your real estate. 423-643-7262 or email busl.

The city of Chattanooga will rely. For inquiries regarding sewer fees. CHATTANOOGA WDEF Chattanoogas City Council unanimously approved a new budget Tuesday night that includes a.

The new certified tax rate for Chattanooga is 18529 per 100 of assessed. The City Council on Tuesday night unanimously approved a 40-cent property tax increase above the new certified rate. With higher values being assigned to most real.

PROPERTY TAX CREDIT OR DEBIT CARD PAYMENT LINK. 2 hours agoThe increase would translate to an extra 100 in tax annually per 100000 in assessed value for city property owners according to officials. At this point property owners usually order help from one of the best property tax attorneys in Chattanooga TN.

All sessions are in-person. Because property tax is always a political and citizen-related issue theres always a lot of interest in what the taxing authorities are doing Thompson said. 101 East 11th Street Suite 100.

To reach our Technical Assistance Center. The new rate is 22373 per 100 of assessed value. Technologies provides enterprise wide business and technology solutions for the City of Chattanooga local government.

The new property tax levy is a culmination of the County Tax Assessors 4-year reappraisal process where all real and personal property were sifted through and all values were reassessed. The increase raises some 30 million in new income dedicated mainly to. Lived in Texas where our property taxes increased 10 YoY every year for a decade.

There will be no property tax increase this year as the rate. Credit or Debit card - 235 or 149 minimum. Current tax rate is 276 per 100 of assessed value.

New Mayor Tim Kelly on Tuesday presented a 302 million city budget that includes over 30 million for employee raises. I want to get out in front and. PROPERTY TAX RELIEF PAMPHLET 2021-----If you are eligible for the Tax Relief Program you may also be eligible to receive payment assistance with your current 2021 City of Chattanooga water quality fees by the United Way of Greater.

2021 Certified Tax Rate. City Treasurers Office 101 East 11th Street Suite 100 Chattanooga TN 37402 423 643-7262. Jun 14 2022 0821 PM EDT.

For more specifics see property tax relief pamphlet 6 for details-----PROPERTY TAX RELIEF APPLICATION 2021.

News Flash Chestermere Ab Civicengage

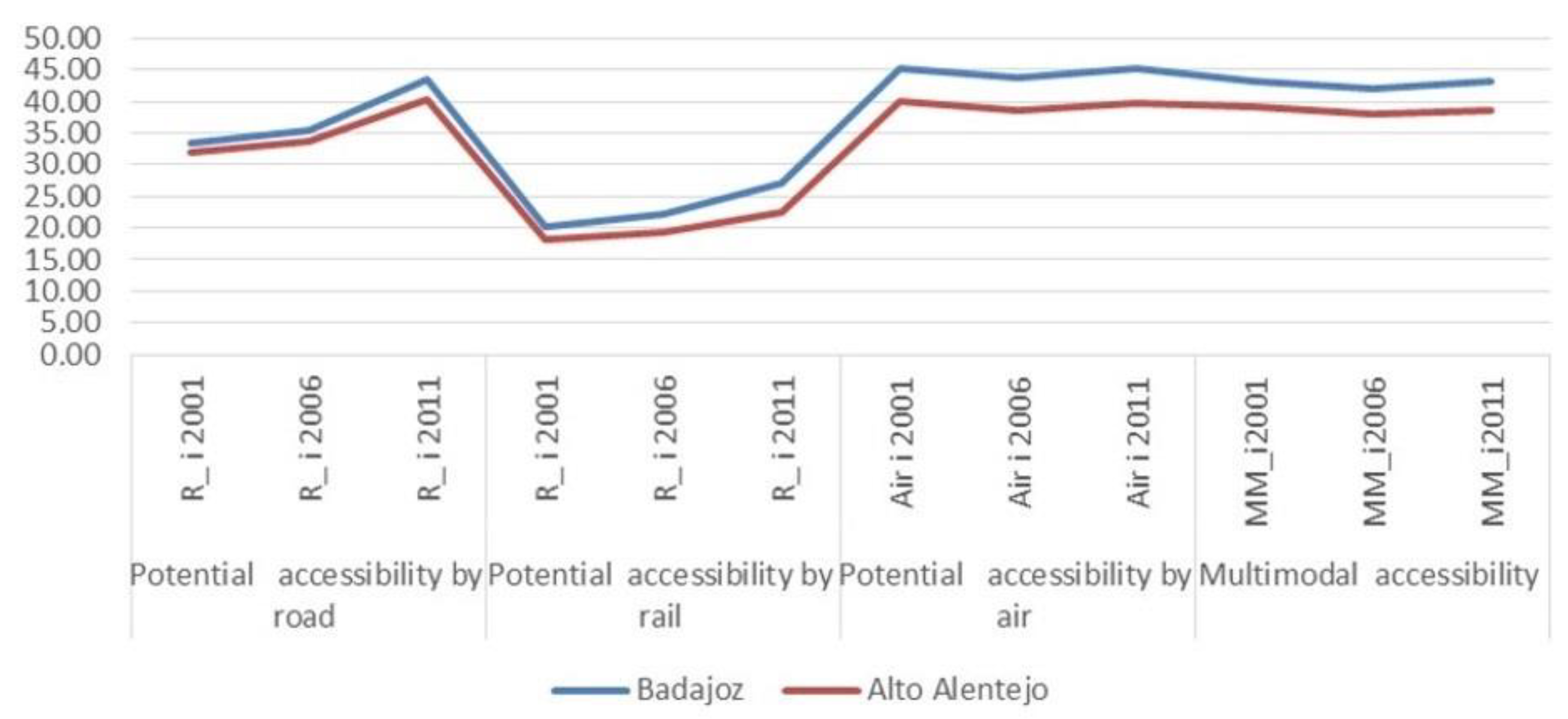

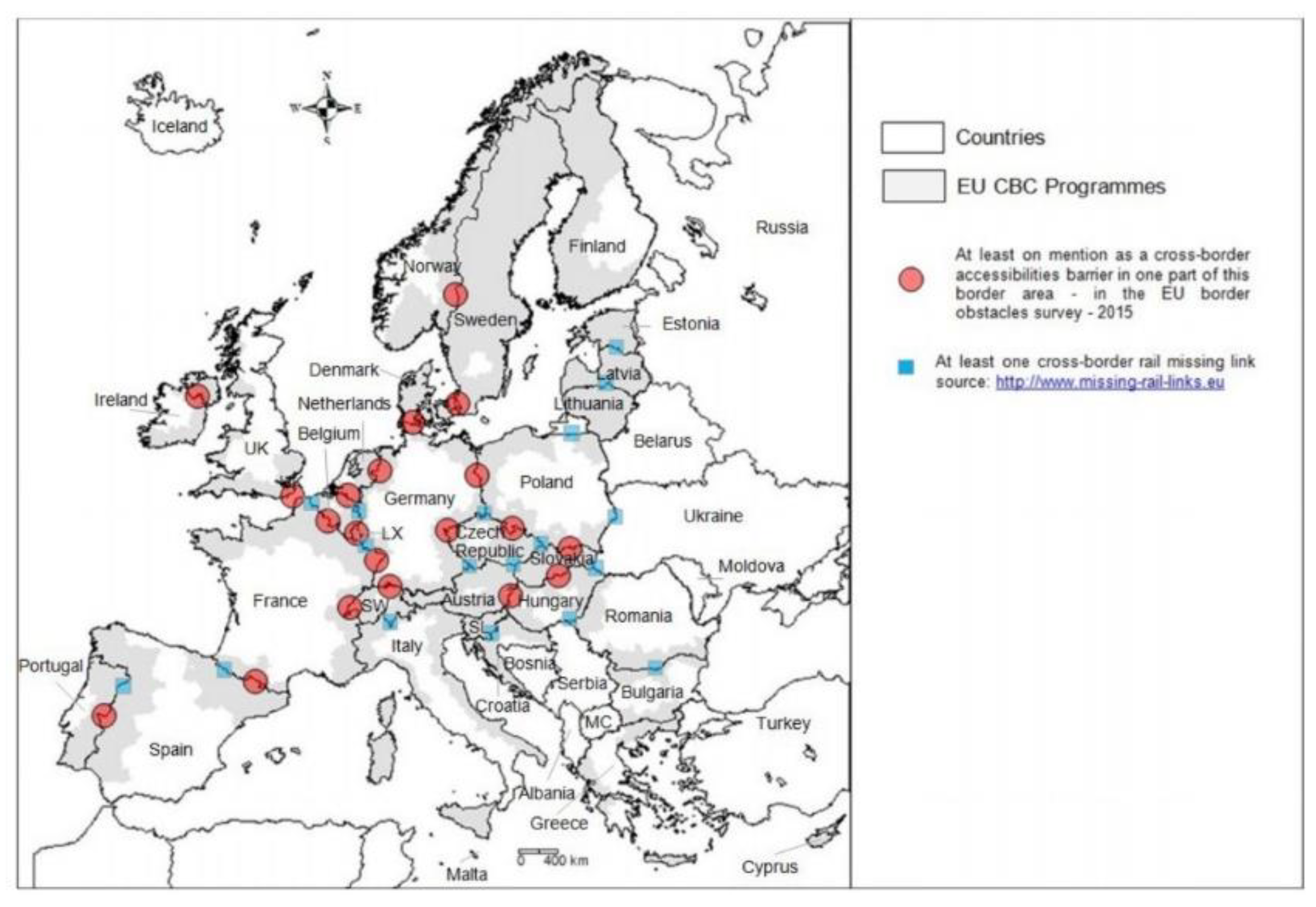

Sustainability Free Full Text Accessibility Dynamics And Regional Cross Border Cooperation Cbc Perspectives In The Portuguese Spanish Borderland Html

3 13 5 Individual Master File Imf Account Numbers Internal Revenue Service

Sustainability Free Full Text Accessibility Dynamics And Regional Cross Border Cooperation Cbc Perspectives In The Portuguese Spanish Borderland Html

Reddit Antiwork Forum Booms As Millions Of Americans Quit Jobs Financial Times

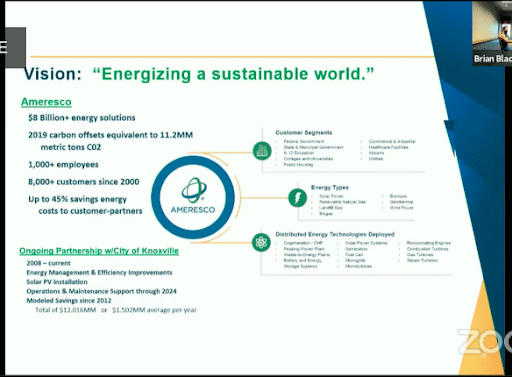

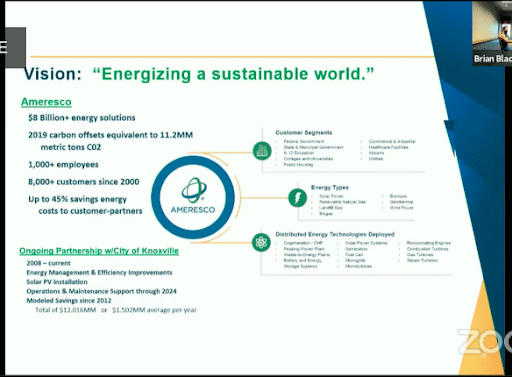

Knoxville Climate Council Delves Into Energy Buildings Sace Southern Alliance For Clean Energysace Southern Alliance For Clean Energy

3 13 5 Individual Master File Imf Account Numbers Internal Revenue Service

3 13 5 Individual Master File Imf Account Numbers Internal Revenue Service

News Flash Chestermere Ab Civicengage

News Flash Chestermere Ab Civicengage

Pdf The Fiscal Effects Of The Covid 19 Pandemic On Cities An Initial Assessment